how much is mass meal tax

Massachusetts local sales tax on meals More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Purchase Amount Purchase Location ZIP Code -or-.

Maura Healey Vows To Pursue Permanent Tax Relief On Day One As Mass Governor Masslive Com

52 rows Visitors to Minneapolis Minnesota pay the highest meals tax.

. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the. Meals Tax with a space opposite for insertion of the amount of the. The Massachusetts income tax rate.

That goes for both earned income wages salary commissions and unearned income. You have reached the right spot to learn if items or services purchased in or. The meals tax rate is 625.

Massachusettss sales tax rates for commonly exempted items are as follows. The meals tax rate is 625. The tax is 625 of the sales price of the meal.

Massachusetts imposes a sales tax on meals sold by or bought from. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. A state excise tax.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. In addition to the state.

Massachusetts is a flat tax state that charges a tax rate of 500. Sales tax on meals prepared food and all beverages. The states room occupancy excise tax rate is 57.

The base state sales tax rate in Massachusetts is 625. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide.

The tax is 625 of the sales price of the meal. A local option for cities or towns. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or.

A combined 10775 percent rate. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. What is mass meal tax.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales. The meals tax rate is 625. Combined rates are also high in Chicago Illinois 1075.

Dining room meals checks must contain the name and address of the vendor and the wording. Sales tax is a tax paid to a governing body state or local for. Overview of Massachusetts Taxes.

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. Are Food and Meals subject to sales tax. Use tax is generally paid directly to Massachusetts by the purchaser.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Pay Sales or Use tax Form ST-6 or Claim an Exemption Form ST-6E with MassTaxConnect.

Christina S Cafe Breakfast Brunch Cafe A Food

Online Menu Of Main Street Grill Restaurant Athol Massachusetts 01331 Zmenu

Everything You Need To Know About Restaurant Taxes

Massachusetts Sales Tax Small Business Guide Truic

Local Tax Option Effective Dates Rates

Massachusetts Income Tax H R Block

Question 1 Supporters Make Final Push Before Election Day The Boston Globe

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

Sales Taxes In The United States Wikipedia

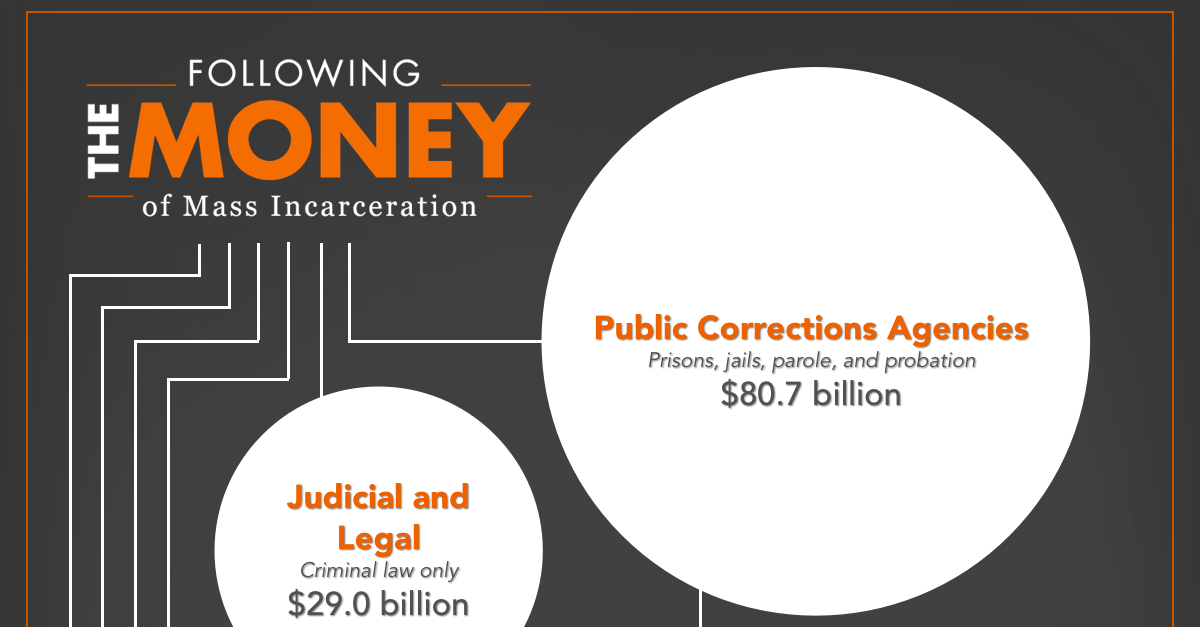

Following The Money Of Mass Incarceration Prison Policy Initiative

Sales Tax By State To Go Restaurant Orders Taxjar

Programme S Slavic Theme With Variations From Coppelia Tchaikovsky Ballet Suite The Nutcracker A Dance Of The Sugar Fairy B Chinese Dance C Trepak Russian Dance Wagner Introduction To Act Iii

Mass Towns That Collect Most Money From Meals Tax

Mass Officials Extend Tax Relief For Local Businesses Boston Business Journal